SBT – The Solution to your Supply Jamiton

A jamiton is a common experience for drivers around major metropolitan areas. We are driving down the highway and traffic comes to a grinding halt. What happened? Researchers in Japan and the US have determined the event occurs when someone driving down the highway comes upon a car driving slower than they want to drive. The driver attempts either to switch lanes causing them to cut off the driver in the next lane subsequently causing that driver to tap on the brakes or they determine they cannot switch lanes, so they tap on their own brakes. Each car behind the first hits their brakes faster. The waves do not dissipate. They can ripple slowly along the road for miles, triggering new mini waves. Researchers at MIT have been studying this phenomenon for years and have begun using complex mathematical models used to study the downstream effects of explosions. These explosive traffic waves are called jamiton’s (a combination of traffic jam and soliton, the term in physics for a traveling wave). “A single instability can trigger an infinitely growing sequence of jamitinos (new mini waves),” the MIT team wrote. “They can only vanish by strong smoothing effects or a lowering of density.”

Recent news of Target’s excessive inventory balances contributed to a significant decline in its stock price as the ensuing promotional discounts led to a significant erosion in its gross margin. Target category managers responded to the COVID-19 pandemic by accumulating significant inventory levels, primarily large ticket electronics and outdoor merchandise. The higher than normal inventory levels seem to be persisting well beyond the pandemic as levels are averaging over 36% more than pre-pandemic levels.

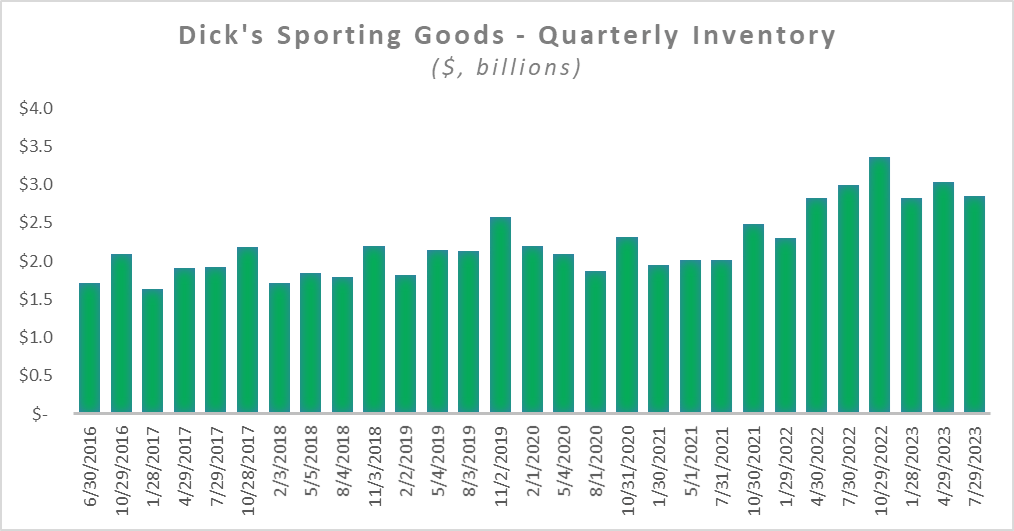

A similar circumstance seems to have occurred at Dick’s Sporting Goods. The pattern of inventory levels at Dick’s followed the same seasonal pattern of Target until the COVID-19 pandemic. Category Managers at Dick’s have acted in a similar fashion as the Target Category Managers leading to significant inventory increases that have persisted.

The level in July 2023 was over 43% higher than the average pre-pandemic level of inventory. When Dick’s released earnings in August 2023 their CFO stated that they “took decisive actions on excess product, particularly in the outdoor category, to keep our inventory well positioned.” Wall Street did not react well. The stock prices of Target and Dick’s responded accordingly. Target shares are down over 20% year-to-date and Dick’s shares dropped over 25% after its earnings call.

The traditional approach Retailers take to reduce inventory is to deeply discount the merchandise at retail. Though expeditious, it creates significant profitability issues and usually diminishes Retailer value. Suppliers are harmed via a reduction in perceived brand value, if not also by required concessions to the Retailer. But this Retailer induced Jamiton that results for Suppliers is even more significant. Entire supply chains are disrupted as Retailers hit the brakes on purchase activity and reorient purchase strategies as they seek to recover from Wall Street’s response leaving Suppliers with significant down-stream liability and exposure.

An alternative approach Retailers can take to reduce inventory is to migrate their Suppliers to Scan-based Trading (SBT). Under SBT the Supplier owns the merchandise until it is purchased by the Customer. The moment the merchandise is scanned at the register, ownership passes immediately from the Supplier to the Retailer to the Customer. The Retailer sends a daily sales file containing the transaction activity, a weekly payment that captures a week of transactions and an associated remittance.

The Supplier is required to employ its IT team to find an efficient method to merge the two files to determine where the payment made by the Retailer fails to conform to the wholesale pricing agreement. The Supplier needs to train the AP department how to analyze the reports and determine a course of action following any payment discrepancies.

The benefits to the Supplier far outweigh these challenges. The Supplier can see customer behavior across all of its Retailer Partners and thereby can make much more efficient decisions regarding reorder quantities, or whether to suspend current orders because they can see that distributed inventory is too high at certain Retailers. As opposed to the traditional buy-sell arrangement whereby the Supplier has no visibility to sell-through, SBT provides the Supplier access to a Google-maps like experience so they can see a potential Jamiton emerging and implement “strong smoothing effects” such as quickly modifying the timing of their inbound shipments or “lower density” by redistributing merchandise to other Retailers.

But how can you get in front of a Jamiton? There are a few companies who have been providing intermediary services for SBT relationships. The Nexxus Marketing Group (Nexxus Group) has invested over $25 million building out software and creating organizational talent and processes that provide timely information Suppliers can employ to implement “strong smoothing effects”. Nexxus Group situates itself between the Supplier and Retailer to closely monitor and maintain the price book. After validating the daily sales file (always in a timely manner), Nexxus Group produces Supplier exclusive reports that provide sales details by store and perpetual inventory values by store. This speed of information and visibility enables the Supplier to optimize procurement, manufacturing and distribution to closely align with customer buying behavior and product availability. The more data the Supplier receives about retail purchases, the more smoothly, easily, and effectively the Supplier can move selected stock and forecast demand. Suppliers can also use this information to help guide Retailers in their product selection, assortment, and promotion. This wealth of data also helps Suppliers anticipate future Retailer needs.

When payment is received the Nexxus Group software compares the remittance detail to the amount expected based on the accumulated daily transaction files and identifies any discrepancies. Nexxus Group then works directly with the Retailer to resolve the discrepancies. Unless the discrepancy is caused by the Supplier, Nexxus Group pays the full amount due on the exact day it is due to the Supplier. Nexxus Group recovers underpayments and returns overpayments to the Retailer.

If you’re a Supplier and want to avoid the Retailer jamiton, contact the Nexxus Group today.

Press Contact Web Content Editor

Web@thenexxusgroup.com